When we talk about investments, stocks and mutual funds come to people’s mind. However, the investment instruments and demographic are facing structural changes constantly. Take US for example, 62% of adults held stocks before 2008, while the ratio declined to 54% in April, 2017. The ratio of how many Americans holding stocks has a positive relation with the asset they possess. The richer a person is, the more stocks he/she holds. The economy is recovering since 2008, so rich people with assets should increase. But the fact is, the ratio of adults holding US stocks declined.

In Taiwan, the demographic of stock investors are aging. Among opening of new accounts in 2018, investors below 30 years old account for less than 10%, while investors over 60 years old account for the largest portion. Take another East Asia country, Korea, over 20% of the people from age 20 to 29 have invested in cryptocurrency before, indicating cryptocurrency trading is more popular among young people. As an alternative to investment instrument, what benefits does cryptocurrency trading provide? We will analyze from three aspects.

1. Barriers to investing

Stocks

Before investing in stocks, you have to go through a long process to open an account. You have to go the stockbrokers in person and are required to prepare certificates and a bank account for account opening procedures. Then you will be asked to fill in many different kinds of documents and wait for several days when everything is ready.

When you are finally ready to invest in stocks, the stock prices of popular technology companies may scare you out: Apple $191, Amazon $1802, Netflix $362. If you only trade one share which is the minimum trading unit, the transaction fee will be $3 which is 1.5% of stock price. You’ll have to trade larger amount to bring cost down, but it would be a high barrier for a fresh graduate.

Cryptocurrency

How about the preparation before investing in cryptocurrency? You only need to find the exchanges that have cryptocurrency trading pairs against fiat like Bitfinex, Coinbase and Kraken. Then finish registration online by uploading the certificates to complete their KYC. After the exchanges verified your account, you can trade your fiat to popular cryptocurrencies like Bitcoin, Ether and USDT. More importantly, cryptocurrencies can be divided into small amounts. You can trade only 0.01 Bitcoin at the time which is approximately $80. This lowers the entry level of investing in cryptocurrencies.

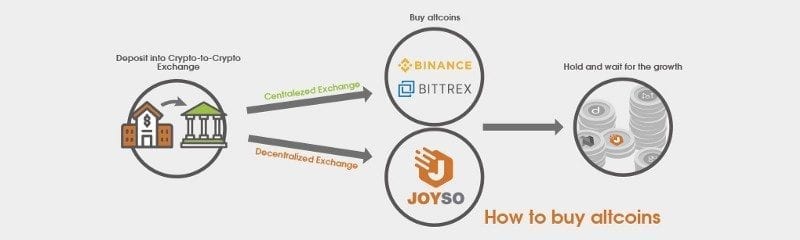

Other than investing in popular cryptocurrencies like Bitcoin and Ether, there are still many kinds of altcoins which have smaller market cap to invest. ICOs can raise funds quickly and face fewer regulations which is more appealing to startups than traditional IPOs. Altcoins have great potential of growth, which create the chance to earn excess profits if you have done enough research.

If these altcoins are listed on exchange, then you can use Bitcoin and Ether to buy them, which is called “crypto-to-crypto”. Crypto-to-crypto exchanges don’t handle fiat currencies, so the users can be borderless and the registration is much faster and easier. The biggest crypto-to-crypto exchange in the world is Binance. However, there are many other exchanges with different features around the globe. For example, a Taiwanese team created a hybrid decentralized exchange JOYSO, which uses smart contracts to process cryptocurrency trading. It can provide liquidity for the altcoins and reduce the risk of being hacked to the minimum simultaneously.

2.Investment cost

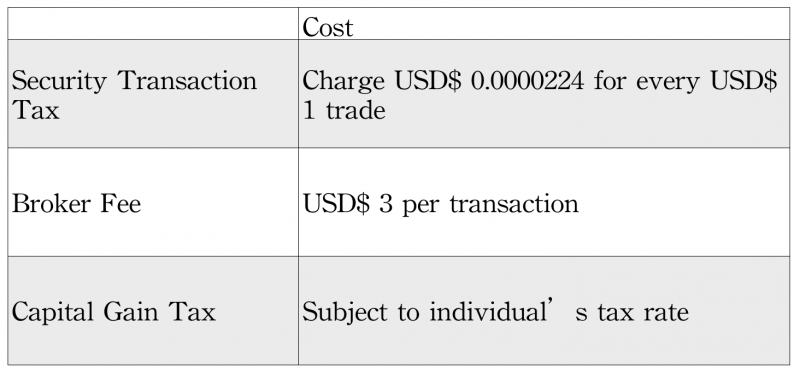

Cost of trading US stocks

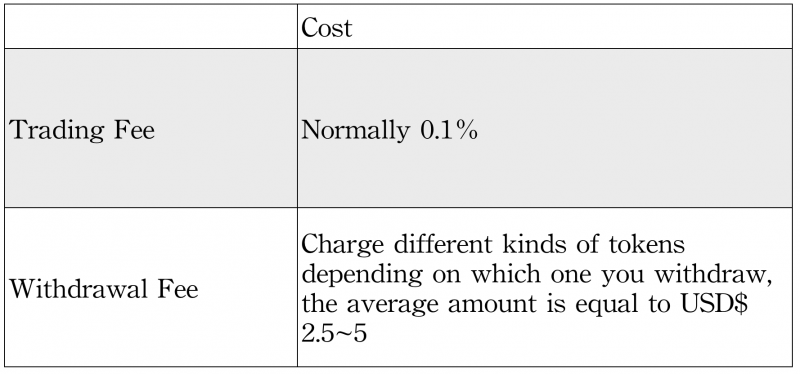

Cost of trading cryptocurrencies

From the comparison above, the cost of cryptocurrency trading is lower. With lower cost, you can earn profits if the price only rises a little. But for stocks, you may lose money even if the stock goes up one or two ticks.

After decades of development, global stock market has become mature. With many professional institutional investors participating and the wide adoption of algorithm trading, it’s hard for new investors to earn any excess profit. If you are the first to enter the stock market, can you gather more information than institutional investors? Or be more discipline than algorithm trading?

Back to investing in cryptocurrency, it gained public focus for only two years, and the market is not efficient enough, which means the price doesn’t reflect the intrinsic value on time. This is the chance for normal investors to earn excess profits from cryptocurrency trading. The current stage of cryptocurrency market is like the age of Westward Movement where the risk is high, while the reward is also tempting. It is suitable for young people who don’t have family burden or people who own some money to invest.

3.Economy Aspect

Stock

Global economy has great impact on stock market. In 2008, when the financial crisis occured, global stock market plummeted around 60%. Until today, the stock market has continued to rise and the economy cycle has reached a peak during these ten years. US Federal Reserve has started interest rate hike which will increase the cost of capital. Thus, the growth of stock market will be constrained by the rising interest rate. And there are fewer investors willing to invest their money when Dow Jones reached a historical high at 25,000 points. Not to mention the trade war triggered by Trump which had cast a shadow on the stock market.

Cryptocurrency

What stage is cryptocurrency at? The indicator that is worth noting is the monthly volatility of Bitcoin. Volatility measures the level of price change. If an investment tool goes up and down widely everyday, then the volatility is big. For example, the price of stocks moves wider than bonds, so the volatility of stocks are bigger than bonds. Besides, the volatility of an investment instrument will vary from time to time. The stock market was unstable during financial crisis in 2008, so the volatility was higher than today.

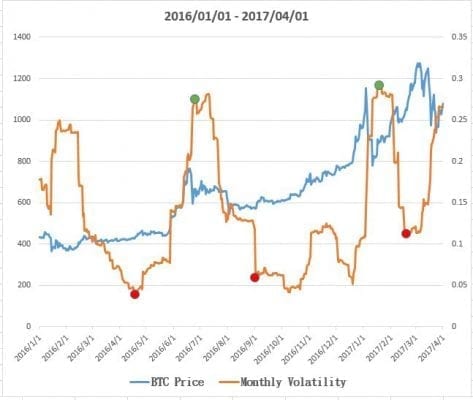

The graphic below shows the price of Bitcoin and it’s monthly volatility from Jan 1st, 2016 to Apr 1st, 2017. Let’s observe the relation between them.

If you buy Bitcoin when the monthly volatility reaches the low level around 0.05 to 0.15 (red dots), you can buy at a relatively cheap price. And if you sell it when monthly volatility rises beyond 0.25 (green dots), you’ll make money.

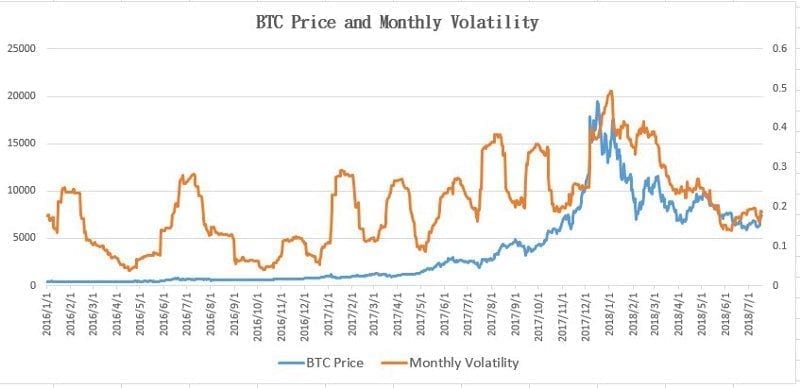

Scroll back to July 2018. We can find Bitcoin’s monthly volatility had reached the low point around 0.1 again from the graphic above. Looks like Bitcoin just completed a huge cycle. The price surged from 2017 to historical high at $USD 20,000 in Jan, 2018. Till now, it falls back to $USD 7,400, and the prices of many tokens are also relatively low. From the graphic, we can see that the volatility had come to the bottom, plus the price of bitcoin rebounded at $USD 6,000 support. So we think the price had reached it bottom which is the best time to invest some money in cryptocurrency.

The risks of investing in cryptocurrencies are quite different from investing stocks. The stock market tumbled due to the trade war tension. While cryptocurrency trading was mostly affected by the ambiguous regulation from the governments. However a clear regulation may eliminates scams to make the ecosystem healthier. As for the risk of being hacked during cryptocurrency trading, investors can choose decentralized exchange to avoid.

Besides, there was a positive sign for cryptocurrency market. The SEC may approve Bitcoin ETF later this year which allows institutional investors with huge funds to invest in cryptocurrencies. The market cap of cryptocurrency now is 280 billion, and the largest investment management company BlackRock handles funds around $USD 4,000 billion. If the institutional investors can enter the market legally, it will be a bullish sign.