There are many new decentralized exchanges (DEX) launched this year. Do you think all the DEXs have similar functionalities or they have certain advantages over the others? The answers can be found below:

DEXs do not have custody of users’ funds, thus reducing the risk of being hacked and enhancing the security level. Except for this common feature, different trading mechanisms will lead to totally different user experience and even increase the trading cost significantly in the long term.

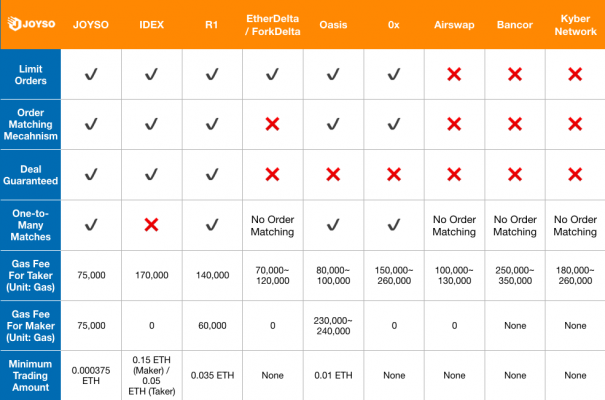

If you are looking for a robust DEX, you can refer to our comparison table found in this article. Understanding the differences between DEXs thoroughly may possibly help in saving your time and money. We made some comparison of several popular DEXs, including JOYSO, EtherDelta/ForkDelta, IDEX, Bancor, Kyber Network, OasisDex, Airswap and the relayers of 0x Protocol and R1 Protocol.

We selected 6 features which are more relevant to users to make the comparisons:

- Limit Orders

- Order Matching Mechanism

- Deal Guaranteed

- One-to-Many Matches

- Trading Cost

- Minimum Trading Amount

This is the comparison table to give you a quick overview. We will discuss about the details of every point below.

Limit Orders

Users are able to place orders with preferred prices if the function is available. In such cases where the exchanges have this function, the market will be filled with orders of different prices. Among the compared exchanges, most of them support limit orders, while AirSwap, Bancor and Kyber Network do not.

Trading on AirSwap is similar to Over-The-Counter purchase. The buyer and seller will negotiate until reaching a price that is accepted by both parties.

As for Bancor and Kyber Network, these exchanges play the role of banks in the forex market. Users can only buy from or sell to these exchanges if they think the ask or bid price is acceptable. When we try to make an actual deal, we discover the price may slip and become different from the original price before the deal is close.

[Comparison]Limit order available: JOYSO, EtherDelta/ForkDelta, IDEX, OasisDex, 0x Protocol, R1 Protocol

Limit order not available: Bancor、Kyber Network、Airswap

Order Matching

If there is no order matching mechanism, what would the user experience be like? Traditional financial markets and centralized exchanges both have order matching mechanisms to improve the efficiency of trading. So users may regard the exchange as not user-friendly if order matching mechanism is not deployed.

As mentioned above, AirSwap does not need to match orders since it is similar to Over-The-Counter purchase. On the other hand, users buy cryptocurrencies directly from Bancor and Kyber Network, so the impact is considered minimal. As for the other DEXs, except for EtherDelta and ForkDelta, most DEXs provides order matching mechanisms.

Most people think EtherDelta and ForkDelta are not easy to use. As we are used to whenever we place a buy order with the price higher than the lowest sell order on the market, the order should be matched immediately (vice versa). With the absence of order matching mechanism, it would be like listing a merchandise on eBay. If you want to make a deal, you have to specify the particular order and seller to buy from. Sometimes, you will even find a sell out product that is not unlisted.

[Comparison]Order matching mechanism available: JOYSO, IDEX, OasisDex, 0x Protocol, R1 Protocol

Order matching mechanism not available: EtherDelta/ForkDelta, AirSwap (Minimum impacts): Bancor, Kyber Network

Deal Guaranteed

If I want to match with a particular order, why the trade is not successful? Indeed, people sometimes found their deals failed after they send their orders using a DEX, giving another reason to call in unfriendly. There could be many causes, the most important function is whether the exchange matches the order off-chain and later send it on-chain for confirmation.

On EtherDelta, ForkDelta and OasisDex, all the transactions are processed on the blockchain. We all know that blockchain only packed the data to produce a block periodically. So if many traders want to match a same order at the same time, only one person will make the deal, then other people will waste their gas fee at failure of trades.

For the cases on Bancor and Kyber Network, the price volatility may cause failures in trades. Since the actual exchange rates fluctuate, the exchanges will ask users to set a minimum acceptable rate. Once the rate is beyond trader’s tolerance, the order will not be matched.

[Comparison]Deal guaranteed: JOYSO, IDEX, R1 Protocol

Deal not guaranteed: EtherDelta/ForkDelta, OasisDex, 0x Protocol, Bancor, Kyber Network

One-to-Many Matches

If a trader places an order with a decent rate and great volume, it might be matched with several orders simultaneously (even it does not exceed the listed price). Under this circumstance, users have to sign the transaction confirmation several times and pay more gas fee if the exchange does not support one-to-many matches. Among the DEXs equipped with order matching mechanism, IDEX is the only one that does not support one-to-many matches. And based on our experience, IDEX normally charges a higher gas fee compared to the market rate. This will increase the trading cost.

[Comparison]One-to-Many matches available: JOYSO, R1 Protocol, OasisDex, 0x Protocol

One-to-Many matches not available: IDEX (No order matching mechanism): EtherDelta/ForkDelta, Bancor, Kyber Network

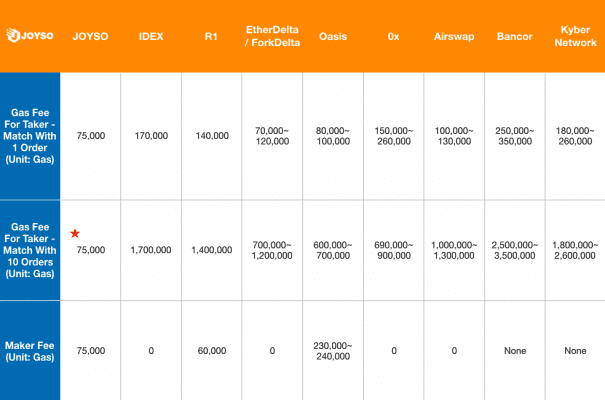

Trading Cost

Trading cost is always an important concern to traders, which includes gas fees and trading fees. To have better profit returns, traders must reduce the costs to the lowest. So, we made a detailed comparison to know the actual fees are collected by these DEXs.

From our comparison, some DEXs does not charge fees from makers but only from takers, and most DEXs tend to charge more fees if the trader matches many orders at the same time. Only JOYSO does not collect a higher fee in the case despite it has a function of one-to-many matches aside from being the lowest trading fee of all the DEXs. Besides, we discover that the admins of IDEX and R1 protocol have the right to collect trading fees up to 10% of the value of any trade.

[Comparison]

Minimum Trading Amount

Minimum trading amount is closely related to one-to-many matches. Because if the exchange does not support one-to-many matches, users will need to sign many confirmations and pay additional fees when they place orders that will match with many small amount orders found on the market. So IDEX set a relatively high minimum trading amount which is unfriendly to people who possess small amount of assets aside from their administrator has the rights to collect trading fees up to 10%. Besides, orders with small residual volume may face forced cancellation.

[Comparison]Minimum Trading Amount

JOYSO: 0.000375 ETH

IDEX: 0.15 ETH (Maker) / 0.05 ETH (Taker)

R1 Protocol: 0.035 ETH

EtherDelta/ForkDelta: None

OasisDex: 0.01 ETH

0x Protocol: Depends on different ralayers

AirSwap: None

Bancor: None

Kyber Network: None

After reading our comparison, you will find out that DEXs vary widely due to their underlying mechanisms. So you must understand the key differences before choosing the one that best fits you.

Comparison Data Provided by Yi-Cyuan Chen, Chief Architect of JOYSO

Article by Jacky, JOYSO